As we near December, some bitcoin enthusiasts are buzzing with anticipation that a ‘Bitcoin Santa Claus rally’ might emerge this year, reminiscent of the surges in 2013 and 2017. This speculative notion suggests that bitcoin often performs exceptionally well during the December festive season, although this isn’t a consistent trend. Nevertheless, this hypothesized event is gaining traction across social media platforms and discussion forums.

Will Bitcoin See a Festive Santa Rally?

The term “Bitcoin Santa rally” is gaining popularity on social media platforms like X, following BTC’s impressive surge of over 10% in the past month and a 128% rise in the past year. This concept, mirroring the stock market’s historic “Santa Claus Rally” where equities typically see a boost between Thanksgiving and Christmas, suggests a similar trend in bitcoin’s market value. Proponents cite two instances to support this theory.

The initial instance unfolded in late November 2013, with BTC valued at less than $1,000 each. During December, bitcoin’s price saw a steady climb, reaching a peak of $1,147 per coin by December 23, 2013. The next instance of such a rally wasn’t until the holiday season of 2017. In late November of that year, bitcoin’s trading value hovered around $8,500.

December 2017 witnessed bitcoin’s entry into a steep upward trajectory, surpassing $19,000 by mid-December and almost hitting the $20K mark for the first time. Yet, in the subsequent bull run leading up to the 2021 holiday season, the pattern shifted. On November 10, 2021, BTC attained its lifetime price high of $69K, but the price took a downturn through December, influenced by volatility and lean holiday trading volumes.

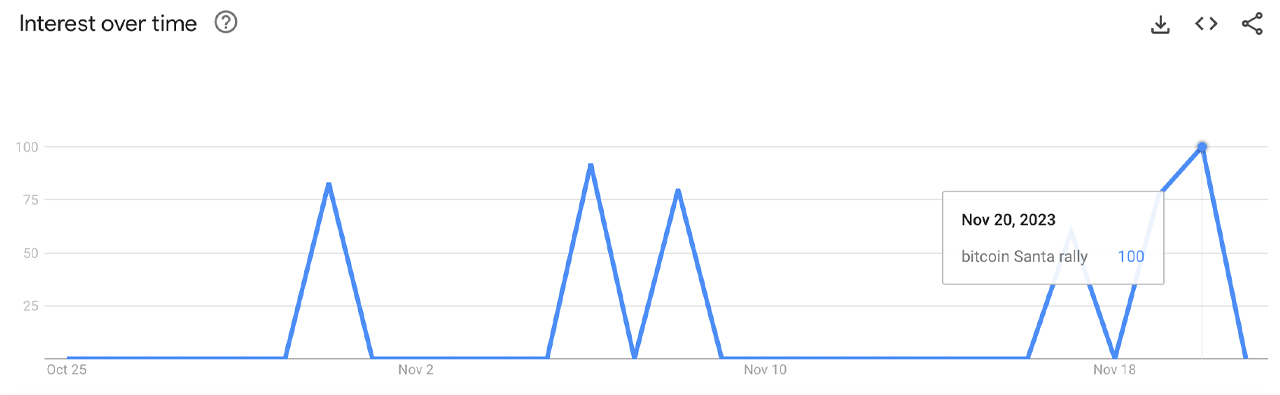

By year’s end, bitcoin struggled to maintain a value of $46,000, challenging the notion of the Santa rally during that particular year. It’s been nearly six years since bitcoin experienced such a rally, yet this doesn’t deter enthusiasts from hoping for its recurrence, sparking trending discussions online. Google Trends corroborates this, with “Bitcoin Santa rally” drawing significant interest this month.

On November 6, 2023, interest in this term soared to 92 out of 100 on Google Trends, then abruptly dropped to zero before climbing back to 80 just two days later. The search term again plummeted to zero, until November 17, when it recorded a score of 60. Yet, on November 20, the query peaked at a score of 100, the highest possible rating according to Google Trends.

Although there’s heightened interest, the likelihood of a rally might be more tenuous in the coming month. For example, December often sees diminished trading volumes, as traders shift their focus to holiday celebrations and family time. This pattern, well-known to market bears, was notably exploited in 2021.

Additionally dampening prospects for a Santa rally is the growing speculation that any significant rally may not materialize until next year, potentially aligning with the anticipated halving event. Typically, January emerges as a recovery month in trading circles, as the influence of year-end tax considerations tends to wane with the onset of the new year.

What do you think about the possibility of a Bitcoin Santa rally taking place this year? Do you see it in the cards? Share your thoughts and opinions about this subject in the comments section below.

source https://news.bitcoin.com/hopeful-bitcoin-enthusiasts-anticipate-a-santa-claus-rally-echoing-past-holiday-season-surges/

Komentar

Posting Komentar