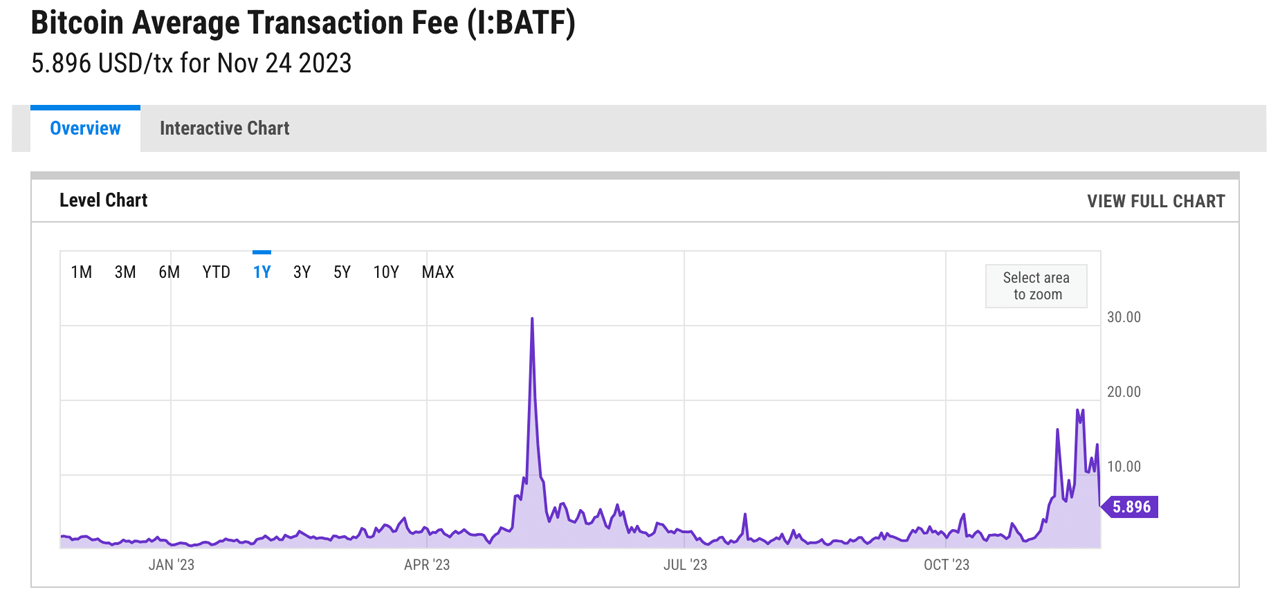

Transaction fees for Bitcoin have eased, following their surge to more than $18 per transaction on two separate occasions last week. As of November 24, 2023, the average fee per transaction stood at roughly $5.89, with the median fee per transfer being $2.86.

Bitcoin Fees Cool Down — November’s Mining Revenue Has Already Outstripped October’s

After reaching a peak of over $18 per transfer on November 16 and 18, 2023, the expense for block space has seen a decline. Data from November 24 shows the average cost per transaction hovered at about $5.89.

This represents a significant decrease from the previous day’s average of $14.06 per transfer, underscoring the fluctuating nature of block space costs over the past week.

Data from Dune Analytics reveals that Ordinal inscriptions continue to flourish, with over 300,000 mints daily following a peak of more than 475,000 inscriptions on November 19. On November 24, a total of 347,791 inscriptions were minted, and as of November 25, bitcoin miners have already processed upwards of 289,000 inscriptions.

This surge in inscriptions, combined with the volume of financial transactions, has resulted in the mempool being filled with over 200,000 transfers.

As of 4:00 p.m. Eastern Time (ET) on November 25, there are 206,697 unconfirmed transactions, which translates to a backlog of approximately 269 blocks worth of space, as per mempool.space.

Fee metrics from mempool.space on the same day, measured in satoshis per virtual byte (sat/vB), indicates that a “no priority” transaction currently costs an estimated $1.17 or 22 sat/vB.

In contrast, a “high priority” transaction is priced at 45 sat/vB, amounting to $2.38 per transaction. Additionally, data suggests that November’s BTC mining revenue is already outstripping last month’s figures, even before the month concludes.

In October, miners earned $885 million in rewards and fees. As of November 25, 2023, miners have earned $945 million in total, including transaction fees and the subsidy.

At 4:00 p.m. (ET) on Saturday, miners have accumulated $124.98 million from fees alone, excluding the subsidy. This figure is nearing the 2023 record of $125.92 million in fee revenue, set in May.

Given the current trajectory and if transaction fees remain high and volatile, it appears likely that miners could surpass this record within the next five days.

What do you think about the network transaction fees’ dynamics? Share your thoughts and opinions about this subject in the comments section below.

source https://news.bitcoin.com/bitcoin-transaction-fees-dip-amid-novembers-surging-miner-revenues/

Komentar

Posting Komentar