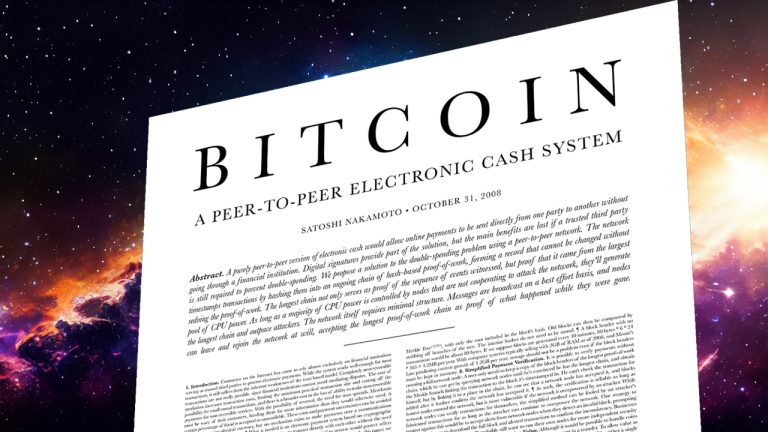

Fifteen years ago, on a memorable Halloween night, Satoshi Nakamoto introduced the world to Bitcoin through a white paper that laid the foundation for decentralized digital currencies. Published on a cryptography mailing list, this seminal document provided a comprehensive solution to the long-standing double-spending problem without the need for a trusted third party.

A 15-Year Journey Into the Heart of Bitcoin’s Revolutionary Design

Today, 15 years later, we delve into the depths of Satoshi Nakamoto’s vision, exploring the revolutionary impacts of Bitcoin and how it has transformed our approach to currency, trust, and financial freedom. Nakamoto’s white paper, titled “Bitcoin: A Peer-to-Peer Electronic Cash System,” was a radical departure from conventional financial systems. It proposed a form of electronic cash that operated entirely peer-to-peer, eliminating the need for intermediaries such as banks or financial institutions.

Since then, Bitcoin has spawned an entire crypto economy worth $1.2 trillion and its own market valuation is around $670 billion on October 31, 2023. Approximately 92.99% of all the bitcoins that will ever exist have been issued, as the money supply is currently around 19.5 million BTC. The heart of Bitcoin’s innovation lies in its ability to solve the double-spending problem, a critical issue in digital currencies where the same funds could be spent more than once.

Nakamoto’s solution was the first decentralized network where transactions are verified by participants through a process called mining, utilizing a proof-of-work (PoW) mechanism. This not only ensures the integrity of transactions but also creates a system where trust is built collectively, rather than relying on a single entity. It introduced a new era of accountability in financial transactions, paving the way for what is now known as triple-entry bookkeeping.

In Nakamoto’s own words:

The network is robust in its unstructured simplicity.

Bitcoin’s allure lies in its straightforward yet robust design, characteristics that have consistently demonstrated their worth over time. To date, the network has operated without a hitch, highlighting the durability of Nakamoto’s innovative design. Since its launch on January 3, 2009, the system has achieved an impressive 99.988% operational rate.

Yet, despite its transformative impact, Bitcoin is not without its challenges; it faces criticisms over its energy consumption and crypto, in general, is under regulatory scrutiny. Additionally, it has also sparked fervent multi-year-long debates about its ability to scale. Bitcoin’s journey serves as a compelling testament to the resilience of decentralized systems and the relentless pursuit of innovation. Looking to the future, the outlook for Bitcoin and decentralized currencies is exceedingly promising.

As technological progress continues and societal views on currency and value evolve, Bitcoin’s foundational tenets of decentralization, transparency, and security remain as relevant as ever. It stands as a testament to the extraordinary possibilities that can be realized when individuals come together to create a system that wholeheartedly embraces economic freedom.

Bitcoin’s white paper can be read in its entirety here.

What do you think about Satoshi Nakamoto’s Bitcoin white paper? Let us know what you think about this subject in the comments section below.

source https://news.bitcoin.com/celebrating-15-years-of-bitcoin-unraveling-satoshi-nakamotos-seminal-white-paper/

Komentar

Posting Komentar