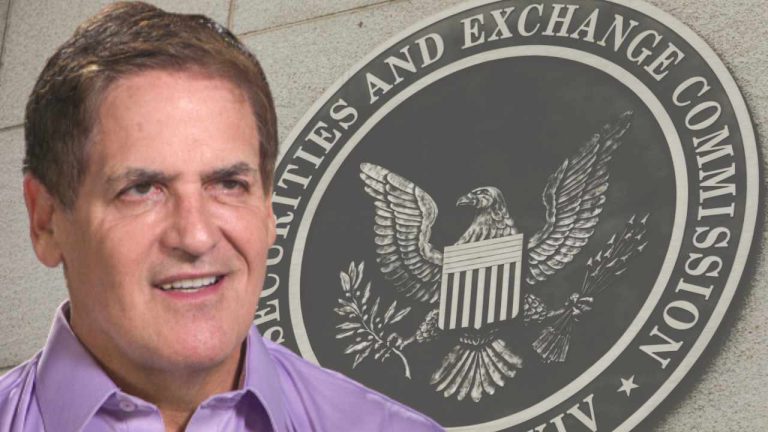

Billionaire investor Mark Cuban, a Shark Tank star and owner of the NBA team Dallas Mavericks, has provided some suggestions on how the U.S. Securities and Exchange Commission (SEC) should regulate the crypto industry, including how the regulator should handle multi-function crypto tokens. His recommendations followed a series of enforcement actions by the securities watchdog, which included charging the Nasdaq-listed crypto exchange Coinbase.

Mark Cuban’s Suggestions for SEC’s Crypto Regulation

Shark Tank star and the owner of the NBA team Dallas Mavericks, Mark Cuban, has engaged in a lengthy discussion on Twitter about how the U.S. Securities and Exchange Commission (SEC) could regulate the crypto sector. The discussion followed a series of enforcement actions taken by the SEC against a number of prominent cryptocurrency exchanges, including and Coinbase.

Citing how the securities watchdog went after the Nasdaq-listed crypto exchange Coinbase for securities law violations as an example, the billionaire described in a tweet Saturday that the current non-crypto-specific registration process offered by the SEC “doesn’t deal with how the token will be traded after the fact.” He suggested:

By doing a crypto-specific registration process, the transparency for the enterprise could increase dramatically. They could eliminate anonymity. Require disclosure on how wallets are secured and maintained. What the wallet addresses are. How and where the token will be traded. Etc.

Coinbase and several other crypto firms have insisted that they tried to register with the SEC but were unable to. “There is no path to ‘come in and register’ — we tried, repeatedly,” Coinbase CEO Brian Armstrong stated after the SEC filed charges against his crypto trading platform.

Cuban also responded to a tweet by lawyer John E. Deaton, who described Saturday: “If you read the Hinman speech still on the SEC website, it states ‘strictly speaking, the token — or coin or whatever the digital information packet is called — all by itself is not a security, just as the orange groves in Howey were not.’ Jay Clayton wrote a letter to Ted Budd in 2019 publicly agreeing with Hinman that the investment contract does not ‘strictly inhere to the asset’ and it’s only about how the asset is packaged and offered.” However, SEC Chairman Gary Gensler has said on multiple occasions that all crypto tokens, other than bitcoin, are securities.

Regulating Multi-Function Crypto Tokens

The Dallas Mavericks owner tweeted on Sunday in reply to Deaton: “I think the other common element of all the assets mentioned in Howey is that they are single function. There has never been a test of the multi-function utility of a token. When an asset is multi-function, it’s impossible to determine the intent of the owner, buyer, or seller, which is why the SEC needs to offer a registration process that is specific to crypto tokens and future multi-function digital assets.”

Cuban added: “Thinking more of the need for a different form of registration for multi-function tokens by the SEC, there is a legal precedent. Look at content. There are trademark, copyright, clearance permissions, music licensing for live, music licensing for on-demand or for sale, video licensing rules, public domain, and more. All content is now digital. All will remain digital.” The Shark Tank star opined:

If we can have a legal framework for digital content that encompasses different media types, the SEC can do the same for token registration for different types of tokens.

What do you think about Mark Cuban’s suggestions on how the SEC should regulate the crypto industry and deal with multi-function crypto tokens? Let us know in the comments section below.

source https://news.bitcoin.com/billionaire-mark-cuban-offers-suggestions-on-how-sec-should-regulate-crypto/

Komentar

Posting Komentar