Crypto Industry’s Reputation Takes a Hit: FTX and Bitcoin Rank at the Bottom of 2023 Axios Harris Poll 100

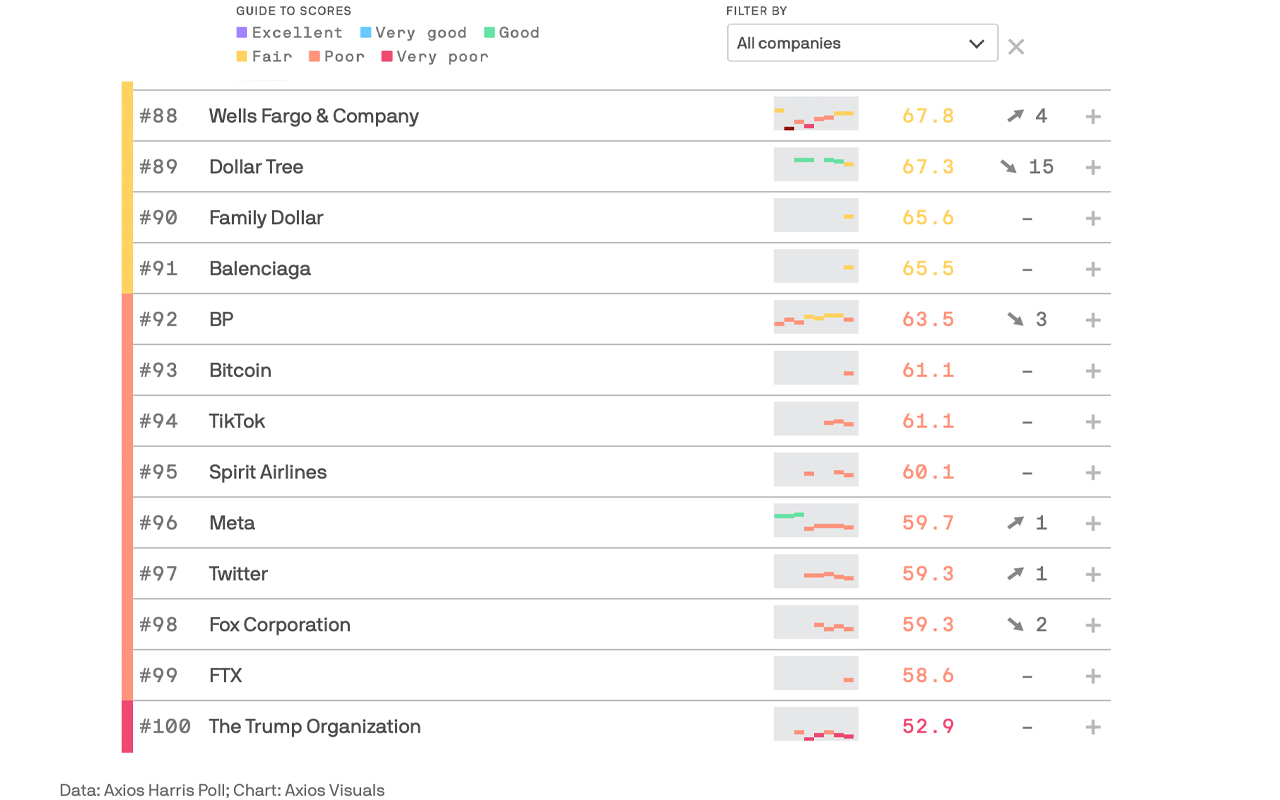

A recent survey conducted by Axios and Harris Poll, which polled 16,310 Americans, has revealed some interesting findings about the reputation of two select entities in the crypto industry. FTX, a crypto exchange that has since gone out of business, has been ranked at the very bottom of the list, coming in at 99 out of 100. Meanwhile, bitcoin has made its debut on the list, ranking a low of 93 among the top companies and organizations.

FTX and Bitcoin’s Reputation Woes Highlighted in Visible Brands Poll

The 2023 Axios Harris Poll 100 has revealed that FTX has a less-than-stellar reputation among the top 100 companies ranked from best to worst in terms of reputation. The survey’s is to “gauge the reputation of the most visible brands in America,” as stated by Axios. Interestingly, the poll has added two crypto-themed elements this year: the now-defunct crypto exchange FTX and the leading crypto asset by market capitalization, bitcoin (BTC).

The poll revealed that FTX and bitcoin are at the bottom of the list, indicating that they have lackluster reputations among a list of other visible brands. FTX, in particular, has landed in the second-to-last position, just above the Trump organization, which is considered the worst visible brand in the country. Meanwhile, Fox (98), Twitter (97), Meta (96), and Spirit Airlines (95) are just above the bankrupt crypto company.

Bitcoin and Tiktok are also on the list, with bitcoin ranking 93 and Tiktok ranking 94. Interestingly, there are firms that stand above bitcoin, including BP (92), Balenciaga (91), Family Dollar (90), Dollar Tree (89), Wells Fargo (88), and Comcast (87). To determine the reputation of the 100 most prominent companies, survey participants were asked to rate them on nine different dimensions. This allowed for the calculation of each company’s Reputational Quotient, or RQ score.

From March 13 through 28, 2023, Axios and Harris conducted the latest survey using the same framework that has been in place since 1999. The top ten on the poll’s list of most visible brands with better reputations than most included Patagonia, Costco, John Deere, Trader Joe’s, Chick-fil-A, Toyota, Samsung, Amazon, USAA, and Apple, respectively.

What do you think the crypto industry can do to improve its reputation and gain the trust of the public? Share your thoughts in the comments section below.

source https://news.bitcoin.com/crypto-industrys-reputation-takes-a-hit-ftx-and-bitcoin-rank-at-the-bottom-of-2023-axios-harris-poll-100/

Komentar

Posting Komentar