G20 Finance Chiefs Widely Recognize Crypto Poses Major Financial Stability Risks, Says Indian Central Bank Governor

The G20 finance ministers and central bank governors recognize that cryptocurrencies pose major risks to financial stability, monetary systems, and cyber security, India’s central bank governor reportedly said. Crypto regulation was among the key topics discussed during the G20 meeting over the weekend.

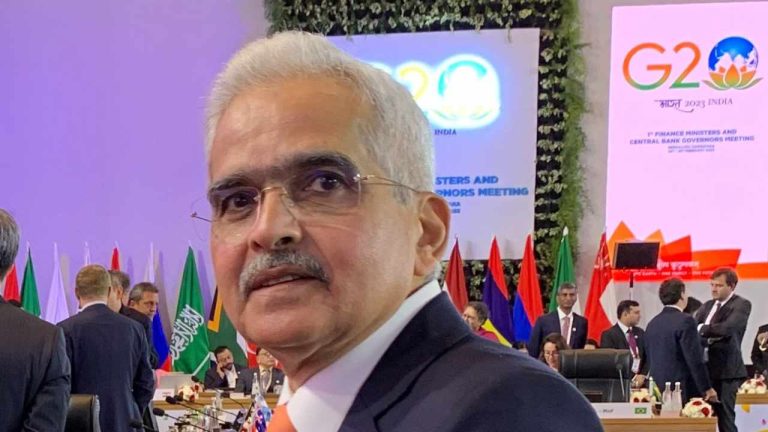

G20 Agrees Crypto Poses Major Risks to Financial Stability, Says RBI Governor

Reserve Bank of India (RBI) Governor Shaktikanta Das talked about cryptocurrency during a media briefing Saturday following the G20 meeting of finance ministers and central bank governors in Bengaluru. According to India’s state-owned media agency News On Air:

Das told the media that there is now wide recognition and acceptance of the fact that crypto currencies or assets are major risks to financial stability, monetary systems, and cyber security.

Das also noted that G20 delegates expressed interest in central bank digital currency (CBDC) pilot projects in India and other countries, the publication conveyed. India’s central bank began its digital rupee pilots in November and December last year.

During a media briefing at the conclusion of the G20 meeting of finance ministers and central bank governors, Indian Finance Minister Nirmala Sitharaman said there is almost a clear understanding that anything not backed by the central bank is not a currency. She emphasized that this is the position that India has taken for a very long time.

During the G20 meeting, India asked the International Monetary Fund (IMF) and the Financial Stability Board (FSB) to produce a joint paper on crypto to help formulate “comprehensive” crypto policies. IMF Managing Director Kristalina Georgieva has called for more crypto regulation, stressing that banning should not be taken off the table. Moreover, the IMF executive board recently published guidance for developing effective crypto policies.

The RBI has said repeatedly that cryptocurrencies that are not backed by the central bank should be banned entirely. However, the Indian finance minister previously said that banning or regulating will only be effective if it is done in collaboration with other countries. U.S. Treasury Secretary Janet Yellen said that the U.S. has not suggested outright banning of crypto activities, but stressed that it is “critical” to establish a strong regulatory framework for crypto.

Meanwhile, delegates from over 200 jurisdictions recently met and agreed on the timely implementation of the Financial Action Task Force (FATF) standards on crypto.

What do you think about the G20 finance ministers and central bank governors agreeing that crypto poses major risks to financial stability? Let us know in the comments section below.

source https://news.bitcoin.com/g20-finance-chiefs-widely-recognize-crypto-poses-major-financial-stability-risks-says-indian-central-bank-governor/

Komentar

Posting Komentar