BNY Mellon Report Compares Bitcoin and Gold, Study Says ‘Gold Is the Only Globally Accepted Currency’

The popular safe-haven asset gold recently posted the lowest settlement in three weeks, as a firm dollar and bond market yields have weakened support for the precious metal. The financial goliath BNY Mellon also published a report about the differences between gold and bitcoin and the study said that the crypto asset “fits the description of a nascent currency.”

A Firm Dollar and Treasury Yields Takes Some Steam Out of Gold’s Market Performance

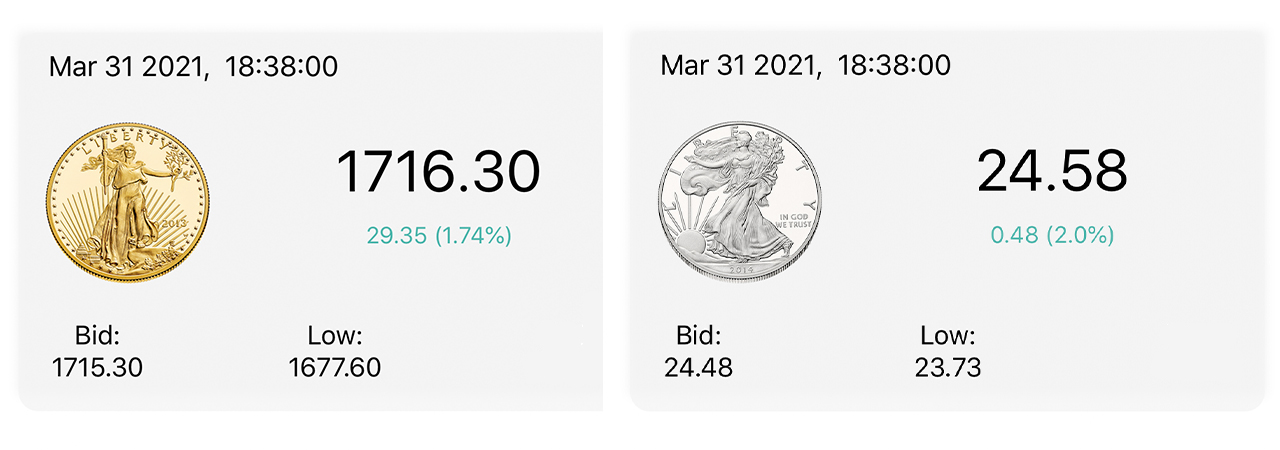

The U.S. dollar has gained some strength in the last two weeks, and crypto-assets like bitcoin (BTC) have increased in value as well. However, the precious metal (PM) gold has seen better days, as gold prices have retreated during the last few weeks. The price of gold dropped under the $1,700 per ounce range last week but today, the PM has managed to climb back above the psychological price zone. At the time of publication, an ounce of .999 fine gold is trading for $1,716.30 after jumping 1.7% in the last 24 hours.

Gold bugs and economists have been discussing Joe Biden’s proposed $3 trillion stimulus package, and it could kickstart gold, silver, and other types of assets that are considered a hedge against inflation. Kitco Metals’ Jim Wyckoff said the dollar’s recent rise and the crazy Treasury yields “are limiting buying interest.”

“The gold and silver market bulls need a fundamental spark,” Kitco Metals senior analyst stressed. Wyckoff also noted that the top two PMs, gold and silver, saw “technically-related selling pressure from the shorter-term futures traders amid still-bearish near-term charts.” Meanwhile as gold has been in a slump, cryptocurrency markets have seen some fresh fervor after prices dropped from highs settled on March 13, 2021.

BNY Mellon Report Compares Bitcoin and Gold

Moreover, the financial institution BNY Mellon has also published a comprehensive study on the attributes of the crypto asset bitcoin (BTC) and the PM gold. BNY Mellon’s report zeroes in on the controversial stock-to-flow ratio (S2F) and the creator Plan B’s alternative model called the stock-to-flow cross-asset model (S2FX).

“The implication from this model is that as bitcoin gains more mainstream momentum and is viewed more like gold,” the BNY Mellon report says. “The scarcity value (as measured by S2F) and the subsequent halving will ultimately drive prices to the gold dot cluster and implied total market value.”

The researchers at BNY Mellon are not buying the digital gold theory and highlighted that BTC “fits the description of a nascent currency.” Although the financial institution’s report does say bitcoin can gold have “similarities” and that BTC could look up to the popular PM.

“Bitcoin is also frequently compared to gold,” BNY Mellon’s study notes. “Indeed, there are many similarities and gold is a worthy role model for bitcoin. After all, gold has been accepted as a store of value and medium of exchange for centuries (nowadays, mostly as a store of value, almost none is used as a medium of exchange). We believe gold is also the only globally accepted ‘currency’ that has circumvented the issue of sanctioning entities.”

However, in mid-February 2021, BNY Mellon set up a digital currency unit that plans to “hold, transfer, and issue” bitcoin.

What do you think about gold’s recent performance and BNY Mellon’s bitcoin and gold comparisons? Let us know what you think about this subject in the comments section below.

source https://news.bitcoin.com/bny-mellon-report-compares-bitcoin-and-gold-study-says-gold-is-the-only-globally-accepted-currency/

Komentar

Posting Komentar